Three of the big banks have just lowered fixed mortgage rates. Will more follow?

[ad_1]

Lenders have been dropping fixed mortgage rates over the past few weeks…except for the Big 6 banks, that is.

But that changed this weekend when three of the big banks—Scotiabank, BMO and TD—finally lowered select terms by about 15 to 25 basis points, or 0.15% to 0.25%. Prior to that, most of the Big 6 hadn’t adjusted their posted special rates since early October, or late September in the case of RBC.

“Banks finally had to budge a bit with yields coming down so much,” said Ryan Sims, a TMG The Mortgage Group broker and former investment banker.

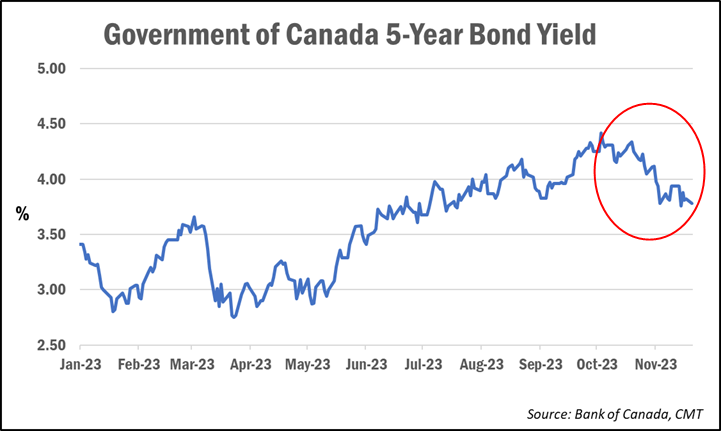

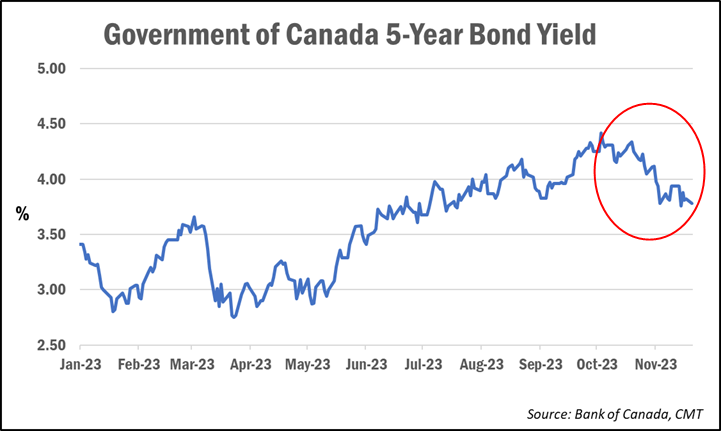

As we reported recently, the 5-year Government of Canada bond yield—which usually leads fixed mortgage rate pricing—has slid about 64 bps—or 0.64%—from its recent high of 4.42% reached in early October. As of Monday, it just closed at 3.78%.

It had sparked a round of rate drops by many mortgage providers in recent weeks, with some dropping rates by as much as 30 bps.

But as mentioned above, the big banks have been noticeably quiet.

Why haven’t the big banks been cutting rates?

There are several reasons why the Big 6 have been slow to react, mortgage experts say.

For one, the big banks are typically less competitive at this time of year, and instead tend to offer their best mortgage deals during the busier spring homebuying season, says Ron Butler of Butler Mortgage.

He expects them to become more competitive again by the end of February. However, in a recent social media post, he noted that while the big banks’ published rates have been slow to adjust, clients can often negotiate better discounted rates compared to what they find posted online.

Of course, there’s also the age-old tale of how interest rates typically move, Butler adds. “Traditionally, in all cases mortgage rates rise faster than they fall,” he said.

The banks are also more sensitive to the slowing market conditions and are basically wanting to maintain their current market share rather than compete aggressively for new business, Sims adds.

“Even though they are not wanting to gain market share, they still need to maintain the market share for future revenue, NIM [net interest market] etc.,” he told CMT. “That being said, banks are adding to their net interest margin right now to offset potential future losses on mortgage products, and really all credit products in general.”

He expects the additional revenue from the widened mortgage margins will go towards increasing loan loss provisions, which are funds set aside to offset potential future losses. In recent quarters, the banks have been setting aside more provisions on the expectation that loan losses will start to increase.

Are more cuts expected?

Sims says mortgage providers are likely to continue lowering fixed mortgage rates—most likely “5 or 10 bps here and there”—including some of the other big banks.

“I do expect the others to follow very…

[ad_2]

Read More: Three of the big banks have just lowered fixed mortgage rates. Will more follow?