Wayfair: Potential 2024 Recession Increases The Risk Of Significant Decline (NYSE:W)

[ad_1]

jetcityimage

As discussed in my recent articles, growing volatility in consumer credit and spending trends are a potential cause for concern for retailers. Retail companies performed very well in 2021 due to pandemic savings. However, as that has resulted in a rise in inflation and a significant decline in household financial stability, we’re now seeing strong indications of an impending reversal in consumer spending. To me, the most important sign is the acceleration in consumer delinquency rates, now well above pre-COVID levels, pointing toward a decline in consumer discretionary spending from Q4 onward. If this prediction pans out, retail companies with poor financial positioning may risk severe losses or financial issues.

Wayfair is among the few online retailers that I believe are at much higher risk. I covered Wayfair (NYSE:W) around the beginning of the year with a bearish outlook. The stock has performed well overall since then as it rose dramatically in what appears to be a “dead cat bounce.” Although I had a bearish view on W in February, I noted that I would not short the stock then due to its high short interest pointing toward a short squeeze risk.

Now we’ve seen the short squeeze playout. At the same time, its prospects have continued to deteriorate, making a short position more viable than before, mainly if we assume a high probability of a consumption-driven recession in 2024. Given its technical position, I believe it is an excellent time to take a closer look at the firm to see how it has developed over the past two quarters. Overall, it appears to me that more significant financial strain is likely in 2024; however, the firm is also making some changes that could prolong its lifespan.

Wayfair In A Financial Hole If Not For Dilution

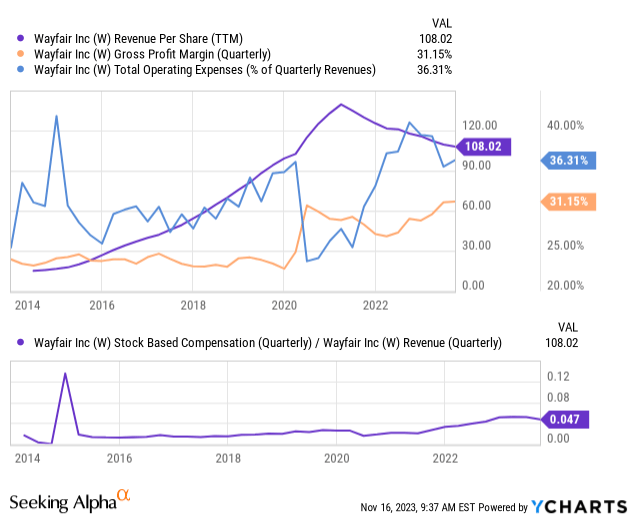

In my opinion, the sharp rise in Wayfair’s stock months ago was not driven by a fundamental rebound but primarily by an unsurprising short squeeze. Wayfair’s revenue, mainly its revenue per share, has continued to decline steadily. Its gross margins have improved materially but remain far below its operating costs-to-sales ratio. See below:

Wayfair has improved its profitability since I covered it last, but it is still far from where it must be to survive. Its operating costs account for ~5% more than its gross margins, meaning its margins remain consistently negative. Some investors will point toward its slightly positive free cash flow during the last two quarters as a bullish indication. Its stock-based compensation was still $139M in the previous quarter, far more than its $42M free cash flow. While that is a good point from a liquidity perspective, investors should not write off its tremendous stock-based compensation rate that accounts for 4.7% of its sales. Given that most retail stocks can expect (at best, 5% margins, most being closer to 2%), it is a huge red flag that it pays so much stock-based compensation.

Despite its slightly positive free cash flow, Wayfair remains in a…

[ad_2]

Read More: Wayfair: Potential 2024 Recession Increases The Risk Of Significant Decline (NYSE:W)