When Will Housing Prices Drop?

[ad_1]

[Editor’s Note: The best medical conference of the year will arrive in a few short weeks, and if you can’t be at the Physician Wellness and Financial Literacy Conference (WCICON24) in person, you can still discover so much by attending virtually. Until January 22, you can save $100 by using the code “VIRTUAL” when you register. With more than 30 speakers who will guide you in the next steps of your financial journey and with a virtual community that allows you to interact with fellow white coat investors and the speakers themselves, the virtual version of WCICON24 is incredibly valuable. Register for the CME-eligible WCICON24 today; it could be the best financial decision you make all year!]

By now, everyone knows that the demand and the number of transactions in the housing market have seen a significant slump as homebuyers delay purchasing a home in hopes of improving affordability.

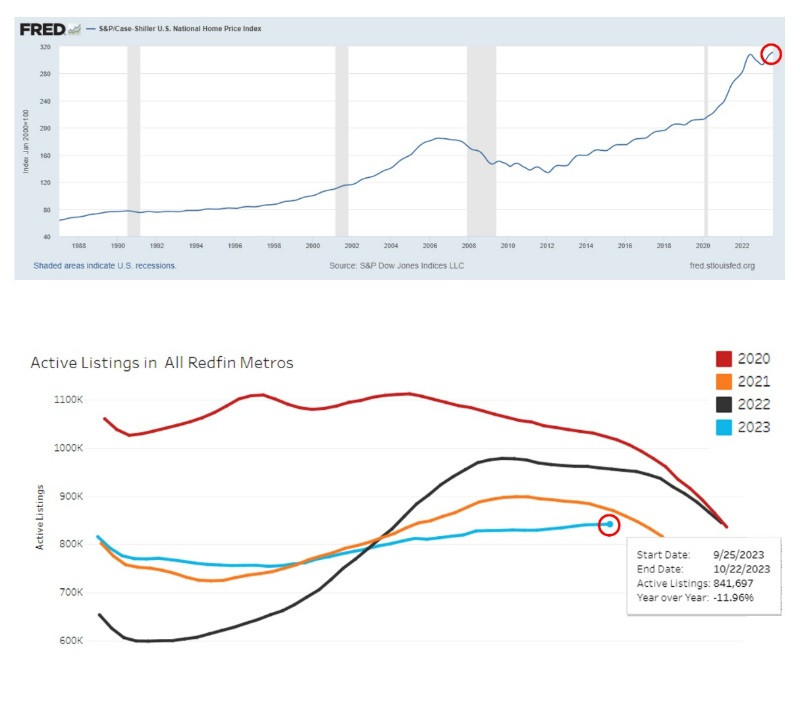

Nationally, home prices are still at all-time highs, and in October 2023, the average 30-year fixed mortgage rate hit a 23-year high cresting above 8%. Despite higher mortgage rates and a lack of affordability, there are still less than 900,000 homes for sale nationally (77.5% fewer homes for sale than in 2010). That is continuing to push up prices despite the common narrative that the housing market is crashing.

How is this possible? Most would assume that when homebuying costs skyrocket, demand would significantly drop, homes would flood the market, and the 2008-2010 housing crash would repeat. Yet here we are, looking at a housing market with anemic inventory and prices still very high nationally. What gives?

Let’s dive into what got us here and what it might take to see more homes come to the market in the coming year.

Why Are There So Few Homes for Sale Right Now?

The housing market is highly unusual right now, and it has been for a while. In fact, since the pandemic, the US housing market really hasn’t been “normal” at all.

The housing market came to a halt in early 2020 as the world stopped, and then it took off like a rocket. Fueled by 30-year fixed mortgage rates under 3% and the work-from-home movement, demand for homes absolutely exploded.

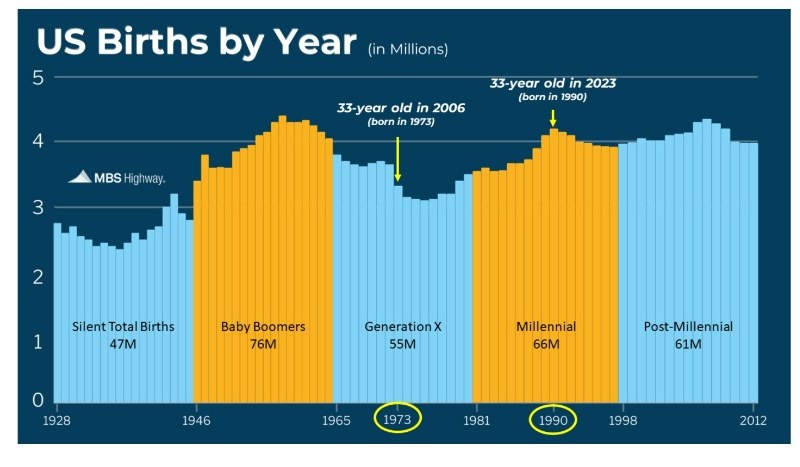

Massive demand from those who were waiting to move up when homes became more affordable collided with an already record-high wave of first-time homebuyers entering the market (the average age of a first-time homebuyer in the United States is 33 years old). Sixty-six million millennials were coming of age, forming new households, and looking to buy homes.

At the same time, current homeowners and investors took advantage of low rates to purchase second homes and investment properties in the hopes of profiting off the growing rental market (Airbnb and short-term rentals were all the rage).

This quickly depleted the supply of homes on the market, which was already trending downward thanks to a lack of new-home construction after the 2008 housing crash. As…

[ad_2]

Read More: When Will Housing Prices Drop?